Education Savings & 529 Plans 2025 — Smart Tax Benefits for Families

College savings can feel intimidating: tuition, books, housing—it all adds up fast. But with the right savings strategy, you can pay smarter.

Enter the 529 plan: a tax-efficient way to grow education savings. In 2025, it's set to offer new opportunities—superfunding, generous gift tax exclusions, and K–12 tuition options—that can help make college dreams more possible.

Let’s map out how families can make every dollar count.

What’s New for 2025

Increased Gift Tax Exclusion: You can now contribute up to $19,000 per beneficiary ($38,000 as a married couple) without triggering gift tax reporting.

Superfunding Option: Make a lump-sum contribution of up to $95,000 (or $190,000 per couple) per beneficiary and have it treated as spread over five years for gift tax purposes.

K–12 Expense Expansion: Starting July 2025, 529 funds can cover up to $10,000 annually in tuition and instructional materials for K–12.

How 529 Plans Work — Tax-Smart Savings

Tax-Free Growth

Earnings grow tax-free when used for qualified education expenses.Qualified Education Expenses Expanded

Includes tuition, textbooks, room & board, and now elementary/high school materials.Flexibility Across State Lines

You can select any state’s 529 plan—even if you're not a resident. Many plans differ in state-grade tax benefits, so compare wisely.

Federal vs. State Rules

Here’s where it gets important—529s are a federal program administered by the states.

Federal (Applies Nationwide):

Tax-free growth on investments.

Tax-free withdrawals for qualified expenses.

No federal contribution cap, but contributions are considered gifts under IRS rules:

$19,000 per individual / $38,000 per couple (2025 annual exclusion).

Superfunding: $95,000/$190,000 spread over 5 years.

IRS Source: 529 Plans Q&A

State (Varies by State):

Each state sets its own lifetime cap per beneficiary (often $300K–$500K+).

Many states offer tax deductions or credits if you use their plan.

Example: Ohio allows a $4,000 deduction per beneficiary, per year.

If you use another state’s plan, you may lose your home state’s deduction.

State Example: Ohio 529 CollegeAdvantage

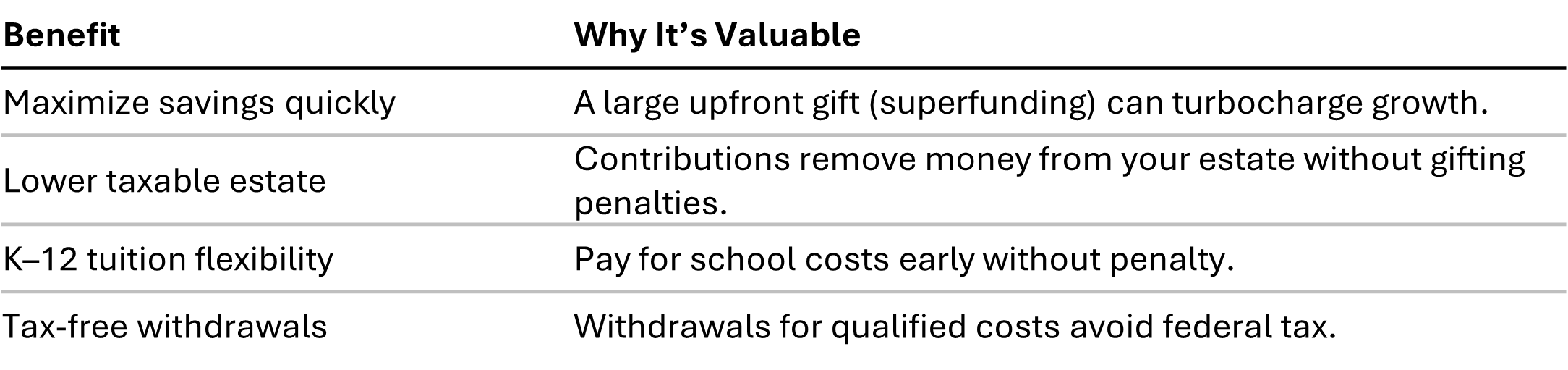

Why It Matters for Your Family

Smart 2025 & Beyond Planning Tips

Use Superfunding if you can—it’s a powerful strategy for committed savers.

Optimize state tax breaks—know your state’s rules and contribution caps.

Compare plans—balance fees, tax perks, and investment options; you’re not limited to your state.

Use funds wisely—stick to qualified expenses for tax-free growth.

Think legacy—529 accounts can be passed down to future generations.

529 plans aren't just for college anymore—they’re flexible, tax-advantaged, and powerful tools for education planning across all ages. In 2025, with superfunding and K–12 benefits, it's perhaps the best year yet to start or ramp up saving.

Ready to compare your state’s 529 perks, set up an account, or weave this into your family tax plan?

Book a consultation to get started!

-

1. How much can you gift to a 529 without reporting?

Up to $19,000 per individual/$38,000 per couple per recipient in 2025.2. What is superfunding?

A lump contribution (up to $95K for individuals, $190K for couples), treated as if spread evenly over 5 years for gift tax purposes.3. Are 529 earnings taxed?

No—if withdrawn for qualified education purposes.4. Can K–12 school costs be paid with 529 funds?

Yes—up to $10,000/year, including curriculum/materials from mid-2025.5. Do I get a federal tax deduction for contributions?

No—but many states offer deductions or credits depending on their plan rules.

Join our 2025 Tax Season Waitlist: tbtxsolutions.com/join